Cumulative pension deposit Suspended indefinitely

Contact the Bank

For additional information, please

- Visit the Bank’s website https://www.conversebank.am

- Visit the Customer Service Office at the Head Office or any branch of the Bank

- Call +374 10 511211

- WhatsApp +374 95 511211

- Skype: conversebank-callcenter

Terms and Condition of Deposit

|

Depositor |

RA resident citizens |

||||

|

Deposit type |

Time deposit with the adding option |

||||

|

Currency |

AMD |

||||

|

Min deposit |

10,000 AMD |

||||

|

Deposit accumulation period |

Difference between retirement and depositor’s age |

||||

|

Periodicity of deposit accumulation |

Not regulated |

||||

|

Annual interest rate |

Simple interest rate |

Percentage yield2 |

|||

|

Within deposit accumulation period |

(CBFR1 + 3.02)%, currently 11.61% |

11.61% |

|||

|

Within repayment period |

(CBFR + 3.27)% / 2, currently 5.93%, which is not subject to amendments after being set |

6.09% |

|||

|

Accrued interests |

Calculated interests are accrued on deposit balance at the end of each year |

||||

|

Maturity |

Prematurely- until the end of the deposit accumulation period, in cases defined by the RA legislation. |

||||

|

At the end of deposit accumulation period |

After reaching the retirement age, the depositor informs the Bank about the deposit repayment period and means, which can be:

|

||||

|

Monthly payments |

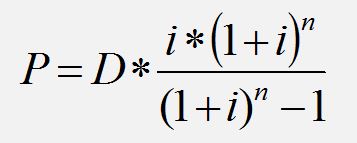

The formulae for monthly one payment is |

||||

|

1 CBFR – Converse Bank CJSC Floating Rate. Is established by the Bank twice a year based on the primary rates, and unless the latter are accessible, based on the secondary rates. Once changed, the simple interest of the agreements is changed no sooner than in a months after notifying the depositor thereon.Primary rates: for AMD – the yield curve of 180-day discount rate government bonds, published by the Central Bank of Armenia on https://www.cba.am; for USD and EUR – "USD 6-month ICE LIBOR" and "EUR 6-month ICE LIBOR" benchmarks accordingly, published by Intercontinental Exchange (ICE) on https://www.theice.com. Secondary rates: for AMD – the CBA set refinancing rate; for USD – Federal Funds rate or the target range - Upper Limit set by the US Federal Reserve Bank; for EUR – the Marginal Lending Facility Rate set by the European Central Bank. Upon inaccessibility to primary rates and application of secondary rates, the secondary rate-based simple interest rate at CBFR is established for deposits so that the amount of the simple interest rate remains unchanged upon the change of the fixed component of the deposit interest rate. The established CBFR rates are published on the Bank’s official site https://conversebank.am/hy/kbht/ and are made available at the Bank. The Bank can revise the floating interest rate of this deposit no more than twice a year. The upper limit of rise or fall of the floating rate is set at +/- 4 percentage points. The CBFR amount can be rounded up to one hundredth. |

|||||

| ATTENTION |

|

Income tax is taxable from interest payments |

|

For cash redemption of deposit opened non-cash, commission is charged at |

|

Savings account opening tariffs for depositors if deposit is opened at branch |

||

|

1 account in deposit currency |

opening |

0 |

|

annual service |

0 |

|

|

Other terms: based on account opening and servicing rules of the Bank |

||

Calculation example

- Initial deposit – AMD 500,000

- Opening day - 13/12/2021

- Maturity – 5 years until 13/12/2026

- Annual interest rate within accumulation period` 11.61% (8.59% + 3.02 interest point), which, suppose, is not subject to amendments for the whole term of deposit,

- The interest income is accrued on deposit balance at the end of each year,

- After the end of the deposit accumulation period, the amount is paid to the depositor in the form of a lump sum,

- During the deposit period, the account is monthly replenished with AMD 100,000 on the first day of each month.

The deposit interest amount is calculated in the following manner:

- 1st month /13.12.2021-12.01.2022/

Interest income per day - 13.12-30.12.2021

500,000.00 (deposited sum) x 11.61/100 (annual interest rate) / 365 (number of days in a year) = 159.04

Interest income for the period 31.12.2021-12.01.2022

502,576.47 (deposited sum + interests calculated and capitalized within a year - 10% income tax) x 11.61/100 (annual interest rate) / 365 (number of days in a year) = 159.86

Total interest income for the period 13.12.2021-12.01.2022

159.04 x 18 + 159.86 x 13 = 4,940.93

- 2nd month /13.01-12.02.2022/

Interest income per day

602,576.47 (deposited sum + interests capitalized+ monthly replenishments) x 11.61/100 (annual interest rate) / 365 (number of days in a year) = 191.67

Total interest income for the period 13.01-12.02.2022

191.67x 31 (number of days for the given period) = 5,941.73

Thus, followed by the same logic of calculation, provided with 11.61% annual interest rate, with 100,000 AMD monthly replenishment within the term of the agreement, on the condition of paying the amount to the depositor in the form of a lump sum at the end of the term, 500,000 AMD "Cumulative pension" deposit will make:

Pre-tax accrued interest: AMD 2,299,867.76

After-tax accrued interest: AMD 2,069,880.99

Sum of replenishments: AMD 5,900,000

Total amount of deposit (deposited sum + replenishments + after-tax interests): AMD 8,469,880.99

Calculated amounts are rounded up to one hundredth.

Annual percentage yield

The interest against the funds on your account are calculated based on the nominal interest rate, and the annual interest yield shows the income you would earn if you redeposited the interests generated against the deposit.

The annual percentage yield is calculated based on the following formula set under the CBA Regulation 8/02 “Calculation of Annual Percentage Yield of Bank Deposits”

APY=(1+r/ո)ո-1

where

- APY – annual percentage yield

- r – annual simple rate

- ո – number of capitalizations of interest in 1 year

General Terms for Opening of Deposit

1. Time deposit agreement is concluded between the Bank and the Depositor.

2. The term of the deposit agreement consists of accumulation and repayment periods.

3. At the moment of signing the deposit agreement, a deposit account (savings account) is opened for the depositor, to which the depositor voluntarily makes accumulative replenishments

4. The depositor has the right to receive the deposit after reaching the retirement age.

5. The deposit cannot be pledged to guarantee the liabilities.

6. Replenishments to the deposit account can be made by any person, if the account details are available.

Calculation and Payment of Interests

1. The interests are calculated against the actual balance of the deposit from the day of opening of the deposit until the day preceding the day of its return to the depositor or withdrawal from the depositor’s account on other grounds.

2. The Bank calculates the interests at a simple interest rate, taking 365 days in a year or 366 days in a leap year as a divisor.

3. The interest amount is calculated on a daily basis against the account balance.

4. The depositor has the right to claim for the amount of his Cumulative pension deposit or a part of it from the Bank in order to transfer it to his Cumulative pension deposit account opened in another bank.

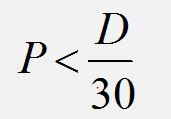

5. At the maturity of the deposit accumulation period, the amount is to be returned to the depositor in his / her preferred form - either in a lump sum or regular payments. Moreover, the amount paid during the first quarter of payment may not exceed 10% of the funds accumulated under the deposit agreement.

6. After reaching the retirement age, the depositor has the right to demand from the Bank the transfer of the Cumulative pension deposit amount or a part of it to the insurance company for the purpose of concluding an annuity agreement.

7. The interests calculated against the deposit, unless the depositor has received in the period set in the deposit agreement, are paid by the Bank to the depositor on the latter’s demand.

8. Unless the depositor demand the redemption of the deposit and the payment of the calculated interest after expiry, the agreement is deemed renewed on the terms and conditions of time deposits applied by the Bank at that point, unless otherwise required in the customer’s deposit agreement or based on the customer’s written instruction.

Additional information

1. Time deposit accounts are opened and serviced free of charge.

2. The deposit account is closed once the deposit agreement expires.

3. No current banking transactions can be executed on the deposit account other than opening and redemption of the deposit.

4. The deposit is opened at branches from the savings account with the currency of the deposit; in the absence thereof, the deposit is opened free of opening and service charge.

5. The interests accrued on the deposit and the funds credited to the deposit account are paid to the depositor free of any commission.

6. The information about the deposit opened with the Bank is deemed bank secrecy and the Bank guarantees its confidentiality.

Early Termination of Deposit Agreement

1. Before reaching retirement age, the depositor has the right to claim for his / her deposit and accrued interests at any time in the form of a lump sum, if at least 2 years have passed since the opening of deposit with the Bank.

2. Before reaching retirement age, the depositor has the right to claim for his / her deposit and accrued interests in the form of a lump sum at any time and the Bank is obliged to pay the deposit and accrued interests, in the following cases:

2.1. The depositor has been recognized as a disabled person with a third degree limitation of working ability, according to the procedure set by the legislation;

2.2. The depositor is in an extremely serious state of health; he / she suffers from incurable diseases of vital organs, which is confirmed by the conclusion of the health care institution authorized by the Government of the Republic of Armenia;

2.3. The citizen-depositor of the Republic of Armenia has left for a foreign country for permanent residence, and the citizenship of the Republic of Armenia has been terminated,

2.4. A foreign-citizen depositor working in the Republic of Armenia returns to his / her country of permanent residence.

2.5. The bank is in the process of liquidation,

2.6. More than 10 years have passed since the depositor opened the deposit account with the Bank.

3. In case of premature termination of the Cumulative pension deposit agreement, the accrued interest is to be paid completely, if the premature termination has taken place in the manner set in the above paragraph 2.

4. If premature termination has been made in the manner set in the paragraph 1, in case of premature termination of the Cumulative pension deposit agreement, the accrued interest is to be recalculated for the accrued interests paid during the previous year at the current deposit interest rate of the Bank (currently 0.1%). The interests calculated and accrued before that (the final day of the year preceding the start of the previous 1 year) are not recalculated.

Communication with the Bank

You can communicate with Converse Bank CJSC either by mail or by email, whichever you prefer. Electronic correspondence is the most convenient, it is 24/7 accessible, is free of any risk of loss of paper-based information and ensures confidentiality.

Tariffs for issuance of statements and references

|

Handover of statements1 at the Bank (VAT included) |

|

- for up to 3-year period: 1,000 AMD - for 3-year and longer period: 3,000 AMD (if stored by the Bank) |

|

|

References to be submitted to various institutions1 (VAT included) |

|

|

For deposits opened in 1 month2 |

5,000 AMD |

|

For deposits opened earlier |

3,000 AMD |

|

Based on online application in the Bank’s site |

3,000 AMD |

1 For the simultaneous issuance of a reference and a statement to the same customer, the charge is applied only to the reference if such charge is set.

2 In the presence of several accounts, the date of opening of the earliest account is considered, irrespective of being included in the reference.

|

Copies of Documents, Transaction Grounds and Other Information (VAT included) |

|

|

For up to 1-month period |

1,800 AMD per document |

|

For up to 1-year period |

3,000 AMD per document |

|

For over 1-year period |

12,000 AMD per document |

|

Postal Delivery of Statement (VAT included) |

|

|

In Armenia and Artsakh |

0 |

|

International |

Delivery service provider’s rate in cases under the law and the agreement In other cases, Delivery service provider’s rate + 1,500 |

|

Delivery of Statements by Registered Mail (VAT included) |

|

|

In Armenia and Artsakh |

3,000 |

|

International |

Delivery service provider’s rate + 3,000 |

|

ATTENTION |

|

The Bank cannot unilaterally decrease the interest rate set under the deposit agreement for the deposit, which the individual has opened on the condition to receive it back at the expiration of a specific period or upon the occurrence of circumstances set under the agreement. |

|

The Bank can revise and amend Tariffs and Rates for additional services by giving a notice to the customers in the manner set under the agreement: by posting a message on the Bank’s website (www.conversebank.am), by making the information available in the Bank’s premises, by post delivery and by other methods offered by the Bank and selected by the Customer, which shall be deemed the proper notification of the Customer. |

|

For the purpose of the Customer’s due diligence in compliance with the RA Law on Combating Money Laundering and Financing of Terrorism, the Bank can demand additional documents or other information from the consumer and as well ask additional questions to the customer on “Know your customer” principle. |

|

Based on the Foreign Account Tax Compliance Act (FATCA) Agreement concluded with the USA, the Bank can collect additional information to clear out your status of a US taxpayer. |

|

The Customer’s rights to dispose the account and the cash on the latter can be restricted by the court decision based on the claims filed by the Enforcement Service or tax authorities or any other competent authority specified in the law. |

|

The funds can be confiscated from the account without the Customer’s instruction by the court decision based on the claims filed by the Enforcement Service or tax authorities. They are reflected in the customer’s bank account statements, which the Bank issues to the Customer in the manner agreed between the Bank and the Customer. |

List of Required Documents

- Customer’s and depositor’s ID document

- Public Service Number (PSN) or reference to the absence of PSN (only for RA residents and/or citizens); is not needed if the customer discloses an ID card bearing the PSN

In addition to the aforementioned documents, the Customer has to disclose the proofs of origin of the amount and/or a declaration on the origin of the financial resources if the deposited sum, as well as the total sum of the previous deposits and the currently deposited sum are in excess of AMD 5 M or the equivalent FX.

The aforementioned documents are not required from the Bank’s accountholder customers, whose legal files contain the relevant documents and proofs of the origin of the financial resources.

Unless the documents are disclosed in Armenian, English or Russian, the apostille or notarized translation into the particular languages is needed.

Your Financial Adviser

“Your Financial Adviser” is an electronic system for search and comparison and selection of the most efficient option of services offered to individuals: https://www.fininfo.am/finhelper/index.php?type=deposit

Notice on Guaranteed Deposit Terms and Conditions

Deposit Guarantee Fund of Armenia is the guarantor of your deposit.

|

The currency structure of the deposit |

Maximum amount of deposit guarantee |

|

|

If you have only an AMD-denominated deposit in the same bank |

16 million AMD |

|

|

If you have only a foreign currency-denominated deposit in the same bank |

7 million AMD |

|

|

If you have both AMD-denominated and foreign currency-denominated deposit in the same bank |

If the AMD-denominated deposit is more than 7 million AMD |

16 million AMD (only AMD deposit is guaranteed) |

|

If the AMD-denominated deposit is less than 7 million AMD |

7 million AMD ( AMD- denominated deposit is guaranteed in full, and the foreign currency-denominated deposit is guaranteed in the amount of difference between 7 million AMD and the difference between the amount of deposits subject to refund) |

|

Location: 15 Khorenatsi, Yerevan (Elite Plaza business center)

Tel. +374 10 583514

Settlement of Disputes

Any dispute between the Customer and the Bank, unless settled through negotiations, is resolved in compliance with the RA laws both judicially and through the Financial System Mediator (for individuals).

Notice on Financial System Mediator

Please be advised that based on the RA Law on Financial System Mediator, the disputes relating to a property claim for up to AMD 10 M or equivalent FX amount arising with regard to the services rendered to you by Converse Bank CJSC can be settled through the Financial System Mediator.

Based on the agreement concluded between the Bank and the Financial System Mediator, the Bank abandons the right to dispute the resolutions of the Financial System Mediator only for property claims not surpassing AMD 250,000 (two hundred fifty thousand) or the equivalent FX, and the amount of the transaction not surpassing AMD 500,000 (five hundred thousand) or equivalent FX.

Location: 15 M. Khorenatsi, 0010 Yerevan

Floor 7, Elite Plaza business Center

Tel. (+ 37460) 70 11 11

Fax (+ 37410) 58 24 21

Email [email protected]

Contact the Bank

For additional information, please

- Visit the Bank’s website https://www.conversebank.am

- Visit the Customer Service Office at the Head Office or any branch of the Bank

- Call +374 10 511211

- Viber +374 95 511211

- Skype: conversebank-callcenter

Updated 28.05.2022