Documentary Letter of Credit

Documentary Letter of Credit (Letter of Credit, Credit or L/C) is the the obligation of the bank to pay a certain amount to the seller of goods against a presentation by the latter of certain documents to the bank in accordance with the letter of credit conditions.

Letter of credit is a reliable and common form of payment and a financing instrument for foreign trade contracts.

The advantages of letter of credit use for the local importer

- Allows avoidance of advance payment, which is the most risky form of payments for import.

- Insures the documentary conformity to the commercial contract.

- Allows the foreign supplier to gain an understanding of the buyer’s solvency.

- Importer can be sure that the payment under the letter of credit will be made only in case of full compliance of the documents to the terms and conditions of the letter of credit. In case of non-compliance, the buyer can refuse making payment.

The advantages of letter of credit use for the foreign exporter

- Protection against non-payment and refusal of acceptance.

- Protection from political risks if the credit is confirmed.

- Immediate availability of export proceeds through the payment at sight or discounting.

- Possibility to receive pre-export finance.

The conditions of letter of credit reflect the conditions of payments and delivery of commercial contracts, and consequently, can have various types.

The main types of letter of credit:

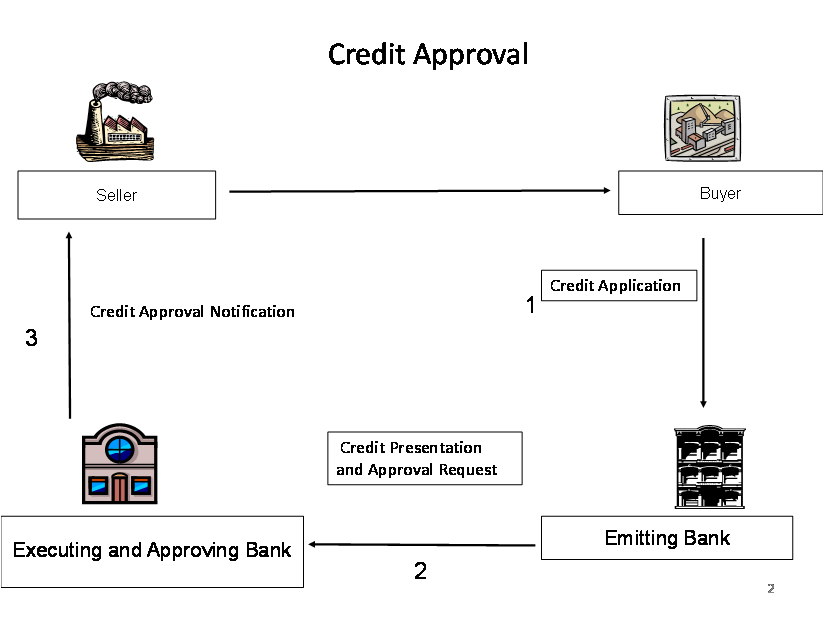

- In accordance with contract conditions the buyer is requested to open a letter of credit confirmed by the seller’s bank. The buyer presents to the issuing bank an application to open a letter of credit and to request for a confirmation of this letter of credit by the bank of the seller (or by any first class bank in the seller’s country).

- The issuing bank obtains an internal credit approval, issues the letter of credit via SWIFT system to the seller’s bank and requests the seller’s bank to advise the letter of credit to the beneficiary and to add its confirmation to that credit. Thus, the seller’s bank is instructed to act as a nominated and confirming bank under the present letter of credit.

- The seller’s bank checks the credit conditions, its authenticity, and informs the seller about credit opening on his behalf. At the same time, the seller’s bank approves a credit limit for the issuing bank and adds its confirmation to the letter of credit. By confirming the letter of credit, the seller’s bank undertakes to pay to the seller in addition to the issuing bank’s obligations defined by the letter of credit. The confirming bank undertakes to pay against the presentation of complying documents in accordance with the credit conditions.

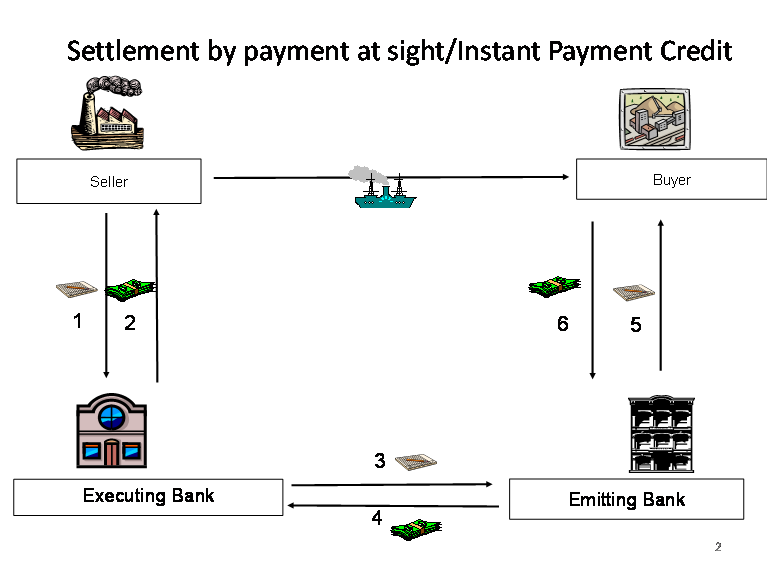

Letter of Credit with payment at sight

![]()

- The seller delivers the goods and presents to his bank (nominated bank as a rule) the documents required by the credit (commercial invoice, transport document, insurance certificate, quality certificate, certificate of origin, inspection certificate, and so on).

- The nominated bank checks the documents, and in case the documents are complying, makes a payment under the letter of credit in favor of the beneficiary/seller.

- The nominated bank sends the documents to the issuing bank and requests the payment.

- The issuing bank checks the documents and pays to the nominated bank.

- The documents are handed over to the buyer in accordance with agreement.

- The buyer, in accordance with agreement, pays the amount defined by documents to the issuing bank.

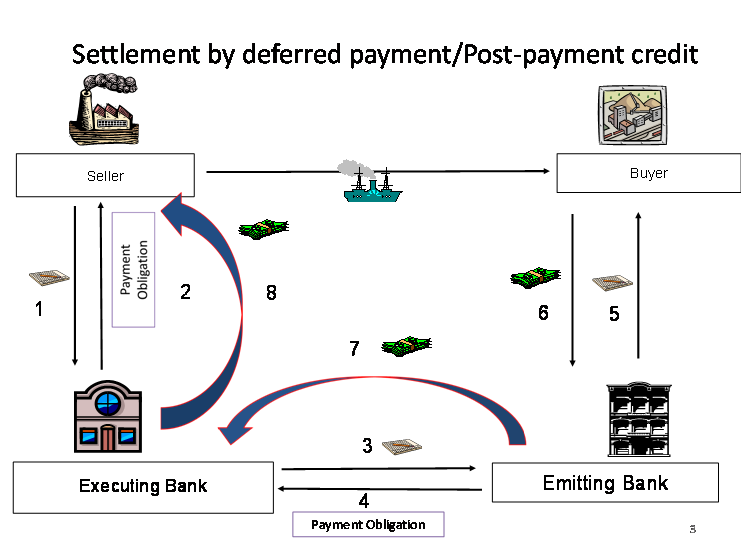

Letter of Credit with deferred payment

- The seller delivers the goods and presents to his bank (nominated bank as a rule) the documents required by the credit (commercial invoice, transport document, insurance certificate, quality certificate, certificate of origin, inspection certificate, and so on).

- The nominated bank checks the documents, and in case the documents are complying, issues a deferred payment obligation to the beneficiary/seller to effect the payment for the documents in a definite time period (for example, at 180 days after the date of shipment).

- The nominated bank sends the documents to the issuing bank and informs the latter about the maturity date for payment under the credit.

- The issuing bank undertakes to reimburse the nominated bank for the payment made in favor of the seller at such maturity date determined by credit.

- The documents are passed on to the buyer in accordance with agreement. The buyer is given the opportunity to get hold of the product and pay for it later (for example, 180 days starting from the day of delivery).

- The buyer pays the amount of documents to the issuing bank at the maturity date established by credit (at 180 days after the date of shipment).

- The issuing bank reimburses the nominated bank for the payment made in favor of the seller (at 180 days after the date of shipment).

- The nominated bank executes its payment obligations in favor of the beneficiary/seller (at 180 days after the date of shipment).

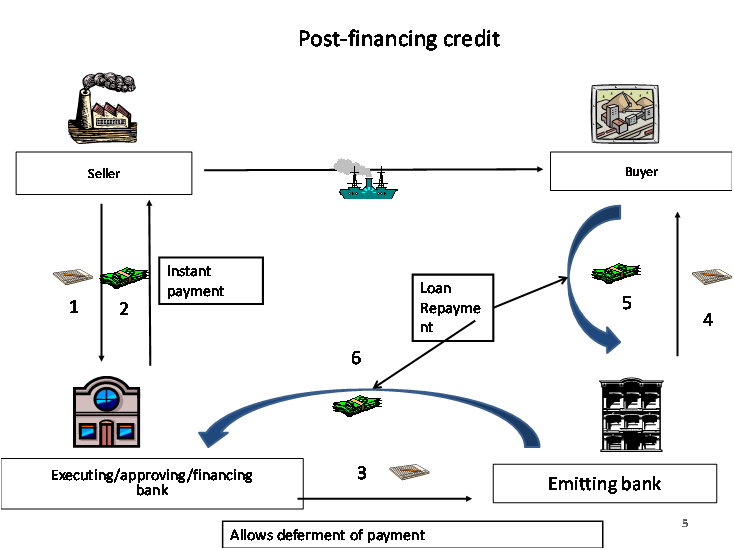

Letter of Credit with post-financing

- The seller delivers the goods and presents to his bank (executing bank as a rule) the documents required by the credit (commercial invoice, transport document, insurance certificate, quality certificate, certificate of origin, inspection certificate, and so on).

- The nominated bank checks the documents and in case the documents are complying, makes a payment at sight in favor of the beneficiary/seller. At the same time, in accordance with the earlier concluded agreement with the issuing bank, the nominated (financing) bank gives the issuing bank the opportunity to defer the payment.

- The nominated bank sends the documents to the issuing bank and informs the latter about the maturity date for the provided post-financing.

- The documents are passed on to the buyer in accordance with the credit agreement credit agreement made between the buyer and the issuing bank. The buyer is given the opportunity to get hold of the goods and to pay for them later.

- The buyer pays to the issuing bank the amount of documents within the time period defined by agreement.

- The issuing bank repays the loan provided by the financing bank.

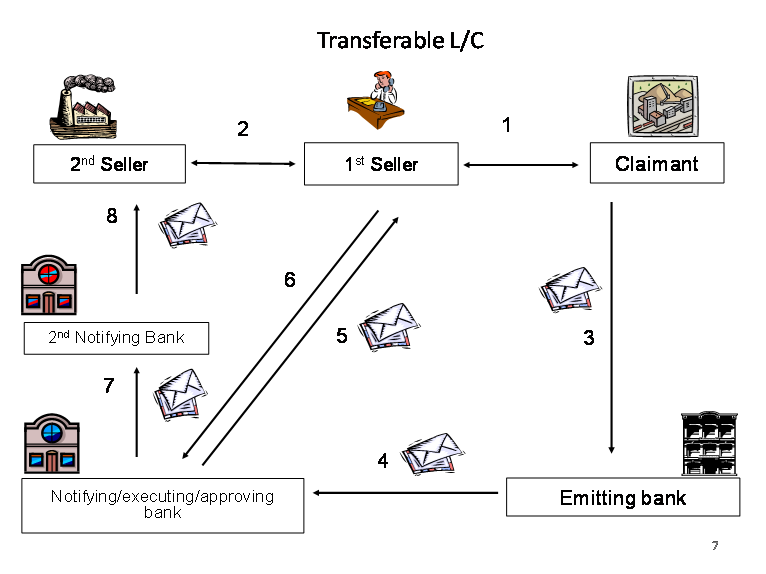

- Transferable letter of credit is a financing tool for the trading intermediary on account of the buyer, who is requested to open such credit. A commercial contract is signed on conditions of payment by the transferable letter of credit.

- The trading intermediary (the 1st beneficiary according to the letter of credit) signs a contract with the product manufacturer (2nd beneficiary) with the condition of payment through letter of credit.

- The buyer (the applicant) applies to the issuing bank with a request to issue transferable credit.

- The issuing bank opens transferable credit through the advising bank in favor of the 1st beneficiary and appoints a nominated (possibly also confirming) bank.

- The advising/nominated bank informs the 1st beneficiary about the opening of transferable credit.

- The 1st beneficiary and the advising/nominated bank sign an agreement regarding the conditions of transfer of the letter of credit to the 2nd beneficiary (the amount of credit and the goods price are reduced, the validity of the letter of credit, the period of presentation of documents and period of delivery are reduced).The 1st beneficiary becomes the applicant under the transferable credit.

- The bank implementing such functions becomes a transferring bank and sends the transferred credit to the bank of the 2nd beneficiary.

- The 2nd advising bank notifies its client- the 2nd beneficiary – about the credit. The 1st beneficiary has fulfilled its contractual obligations having opened the required credit in favor of his counterparty.

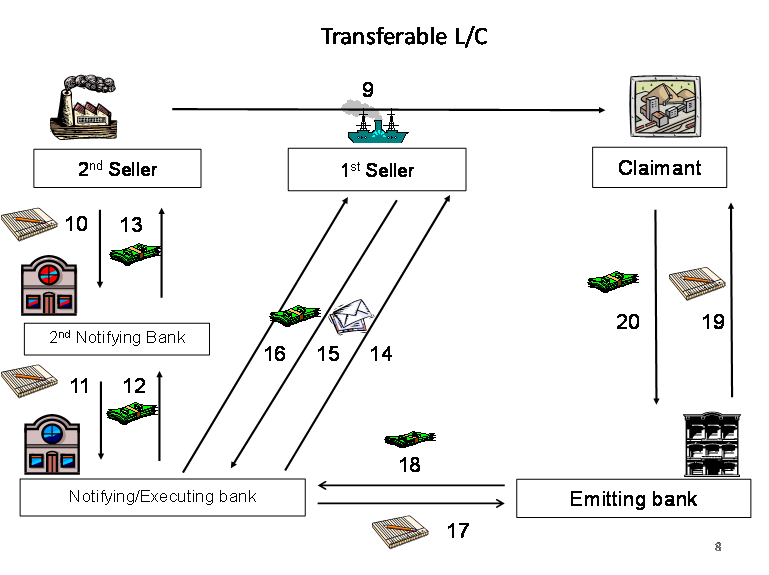

9. The product manufacturer (2nd beneficiary) delivers the goods in accordance with the instructions of the intermediary.

10. Presents the documents to the advising bank.

11. The advising bank presents the documents intended for payment to the nominated bank.

12. The nominated bank checks the documents and pays the amount of the documents to the bank of the 2nd beneficiary.

13. The 2nd advising bank transfers the funds to the 2nd beneficiary.

14. The transferring bank requests the 1st beneficiary to substitute the documents in accordance with the letter of credit transfer agreement. The commercial invoice and the draft are substituted.

15. The 1st beneficiary presents the new documents.

16. The transferring bank pays the 1st beneficiary the amount difference in price.

17. The transferring bank requests the issuing bank to make payment and sends out the documents.

18. The issuing bank reimburses the requested payment.

19. The issuing bank sends the documents to the applicant.

20. The applicant pays the amount of the documents in accordance with the agreement reached with the issuing bank.

Tariffs

Documentary Letter of Credit application form

Contact details

For more information in relation to Trade Finance and/or Documentary operations please contact:

Nelli Kocharyan

Head of International Relations and Trade Finance Division

Tel: +374 10 511 250

Vahe Grigoryan

International Relations and Trade Finance Division, Specialist

Tel: +374 10 511 226