Bank Guarantees and Stand-by Letters of Credit

International bank guarantees and stand-by letters of credit are widely used as a security for payment and performance risks in international trade transactions. Nowadays Converse Bank works with all types of international guarantees and stand-by letters of credit and can issue such obligations at the request of its clients.

A bank guarantee is the obligation of Converse Bank, issued by order Converse Bank’s customer (the applicant) in favor of the counterparty of the applicant (the beneficiary under the guarantee) to make a payment against beneficiary’s written demand for payment of the amount stated in such demand within the guarantee amount, in case of non-performance of the applicant’s obligations under the underlying contract.

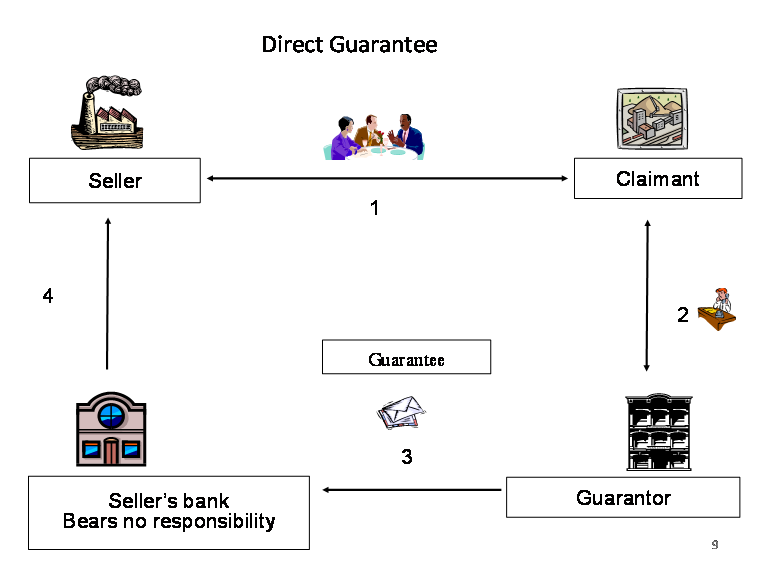

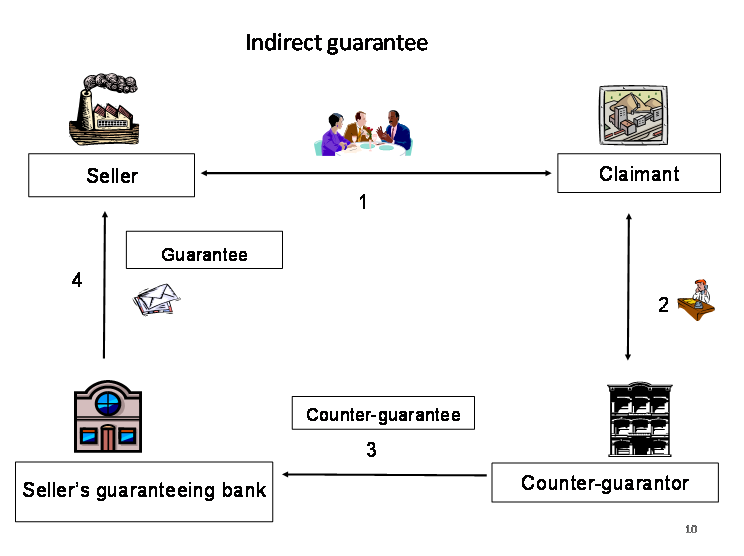

There are direct and indirect guarantees.

- The underlying contract, which requires the issuance of a direct guarantee.

- The applicant approaches the bank with the application for issuance of guarantee.

- Under a condition of a positive credit decision, the issuing bank issues a guarantee in favor of the beneficiary and sends it to the beneficiary via the beneficiary‘s bank.

- The beneficiary’s bank checks the authenticity of the guarantee and informs the beneficiary about issuance of guarantee in his favor. The beneficiary’s bank bears no responsibility for payments under the guarantee. The beneficiary can present a demand for payment to the guarantor bank only.

- The underlying contract, which requires issuance of a guarantee from the bank of the beneficiary.

- The applicant applies to his bank with the request to issue a guarantee.

- Under a condition of a positive credit decision, the bank of the applicant sends to the bank of the beneficiary a request to issue a guarantee in favor of the beneficiary and issues its counter-guarantee in favor of the bank of the beneficiary.

- bank of the beneficiary issues its guarantee in favor of the beneficiary. The beneficiary can present a demand for payment to the guarantor bank only.

Types of Guarantees

Payment guarantee: The commercial transaction is implemented on open account basis. The seller agrees on this condition provided that the buyer’s bank issues a payment guarantee in his favor. The bank pays under the guarantee against the receipt of the seller’s written demand for payment, when the latter confirms that the buyer has not performed his payment obligations under the contract.

Tender guarantee: The tender guarantee secures the compensation of expenses, which could be borne by the organizer of tender in case the tender participant changes or cancels its tender proposal, or if he/she being the winner of the tender, refuses to sign the respective contract or to provide additional guarantees.

Performance guarantee (Performance bond): The buyer often requires provision of performance guarantee from the supplier’s bank, so that the supplier performs his contractual obligations. The bank undertakes to reimburse the buyer (usually 10-50% of the contract amount), if the seller does not perform his contractual obligations.

Advance payment guarantee: The buyer can make an advance payment to the supplier in order to obtain equipment and materials (pre-export financing). The buyer can require advance payment guarantee from the supplier’s bank in order to guarantee the return of advance payment made to the supplier, if the merchandise is not delivered.

Loan repayment guarantee: The guarantee covers the non-performance risk of payment obligations (repayment of loan, interest payment, and so on) defined by loan contract.

Stand-by Letter of Credit

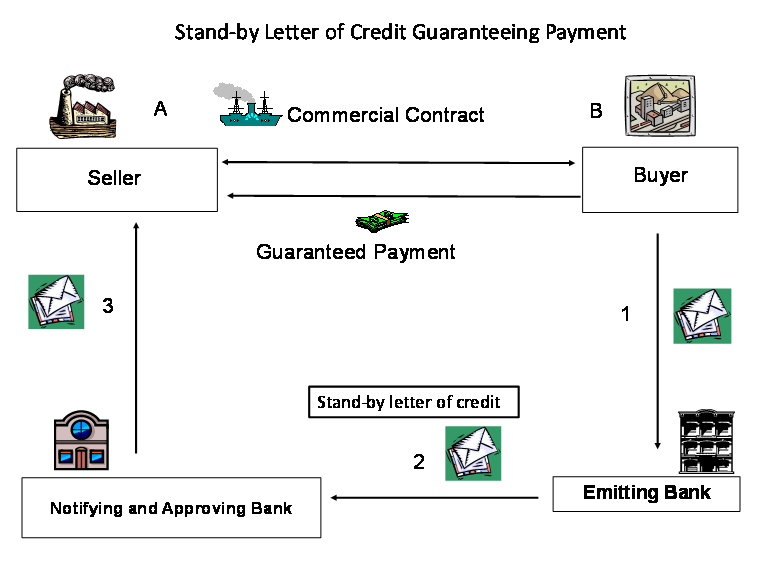

Stand-by letter of credit is (like bank guarantee) the emitting bank’s (Converse Bank) payment obligation, which is issued at the request of emitting bank’s (Converse Bank) client (importer) in favor of the seller (foreign exporter). The bank undertakes to pay a certain amount to the seller if the latter presents a written demand for payment and a statement that the issuing bank’s client (importer) has not performed his payment obligations according to the underlying contract.

Nevertheless, stand-by letter of credit is merely a type of letter of credit and performs the role of payment guarantee, which is issued in the form of documentary letter of credit. The letter of credit form of such guarantee gives the opportunity to use it more easily in international transactions, because the main operations with that type of credit are carried out in the same way as in case of documentary letter of credit (advising, confirmation, presentation of documents, check-up of documents, payment, and so on). The use of stand-by letter of credit also gives the opportunity to receive a deferred payment under import of goods.

The differences between stand-by letters of credit and documentary letters of credit

- The main difference between these two types of credit is in the beneficiary’s obligations.

- In case of transactions performed with documentary letter of credit, the beneficiary (exporter) must prove that he has fulfilled the conditions of credit, by presenting documents evidencing delivery of merchandise mentioned in credit.

- In case of stand-by letter of credit, the seller must present a document stating that the applicant has not fulfilled his obligations towards the beneficiary.

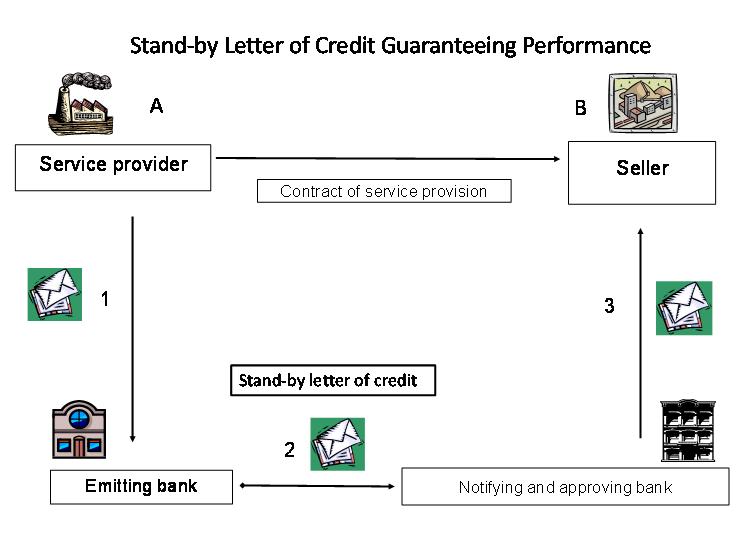

Stand-by Letter of Credit Guaranteeing Performance

Stand-by Letter of Credit Guaranteeing Payment

Contact details

For more information in relation to Trade Finance and/or Documentary operations please contact:

Nelli Kocharyan

Head of International Relations and Trade Finance Division

Tel: +374 10 511 250

Vahe Grigoryan

International Relations and Trade Finance Division, Specialist

Tel: +374 10 511 226